About Us

Ways to control tariffs

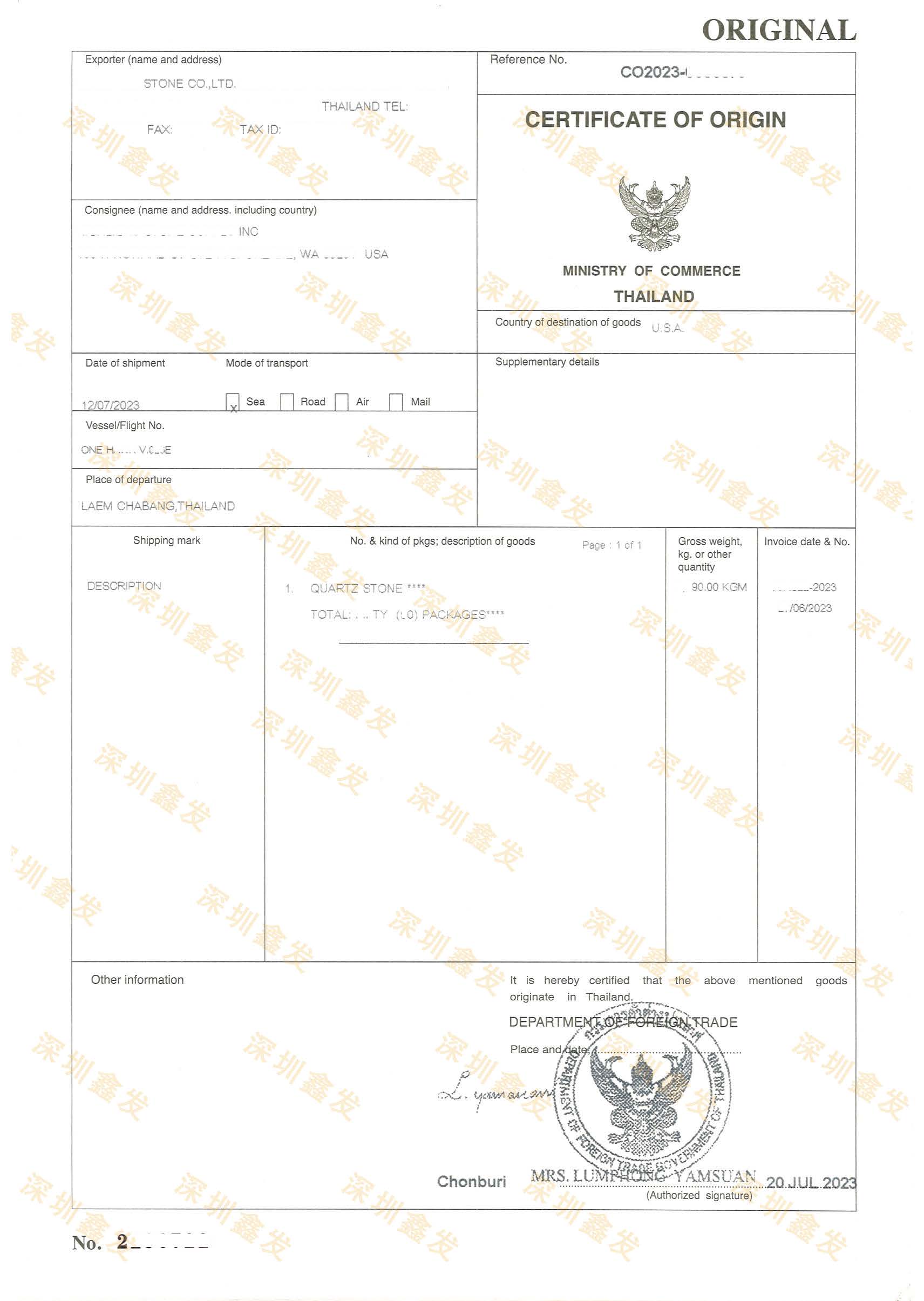

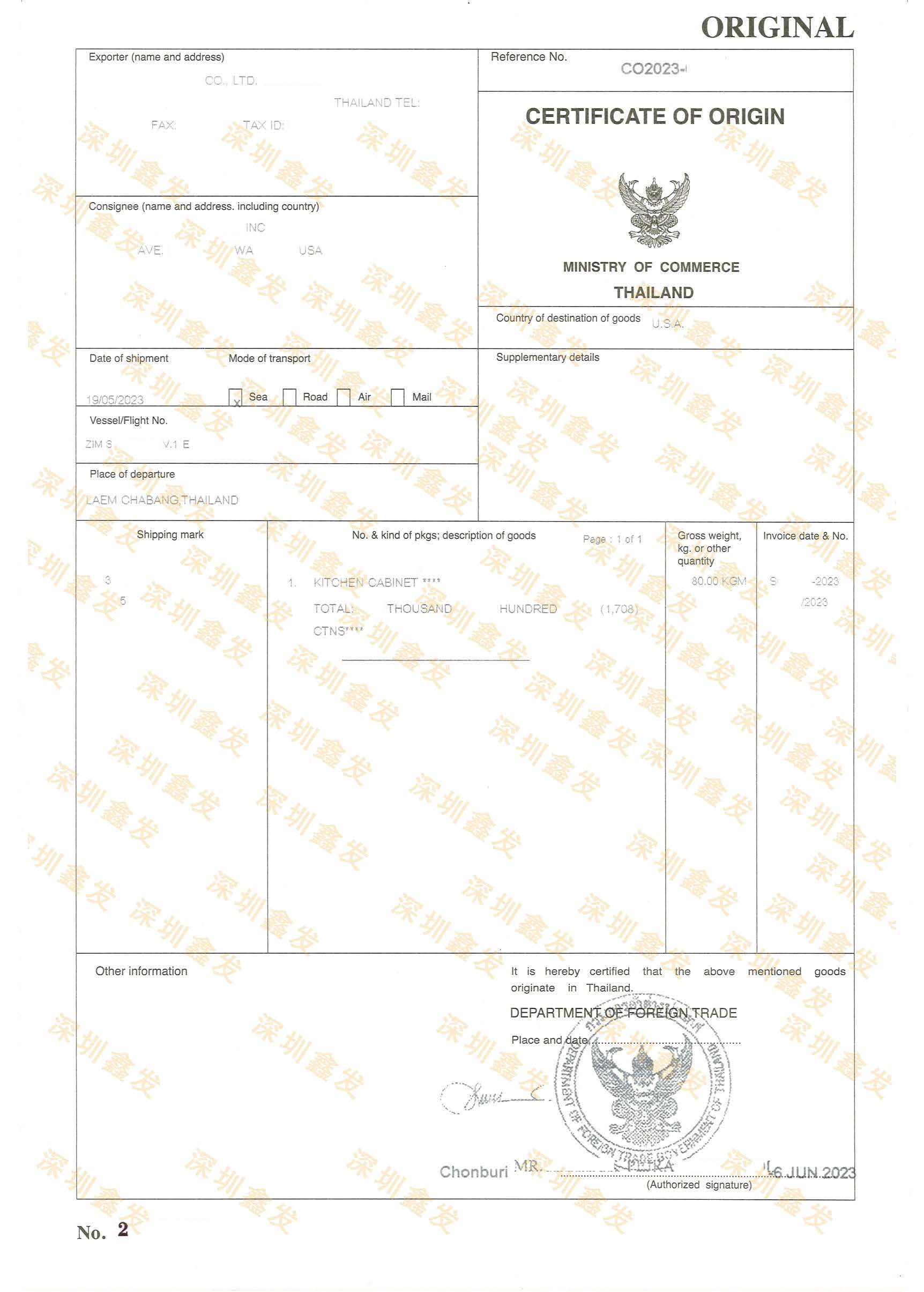

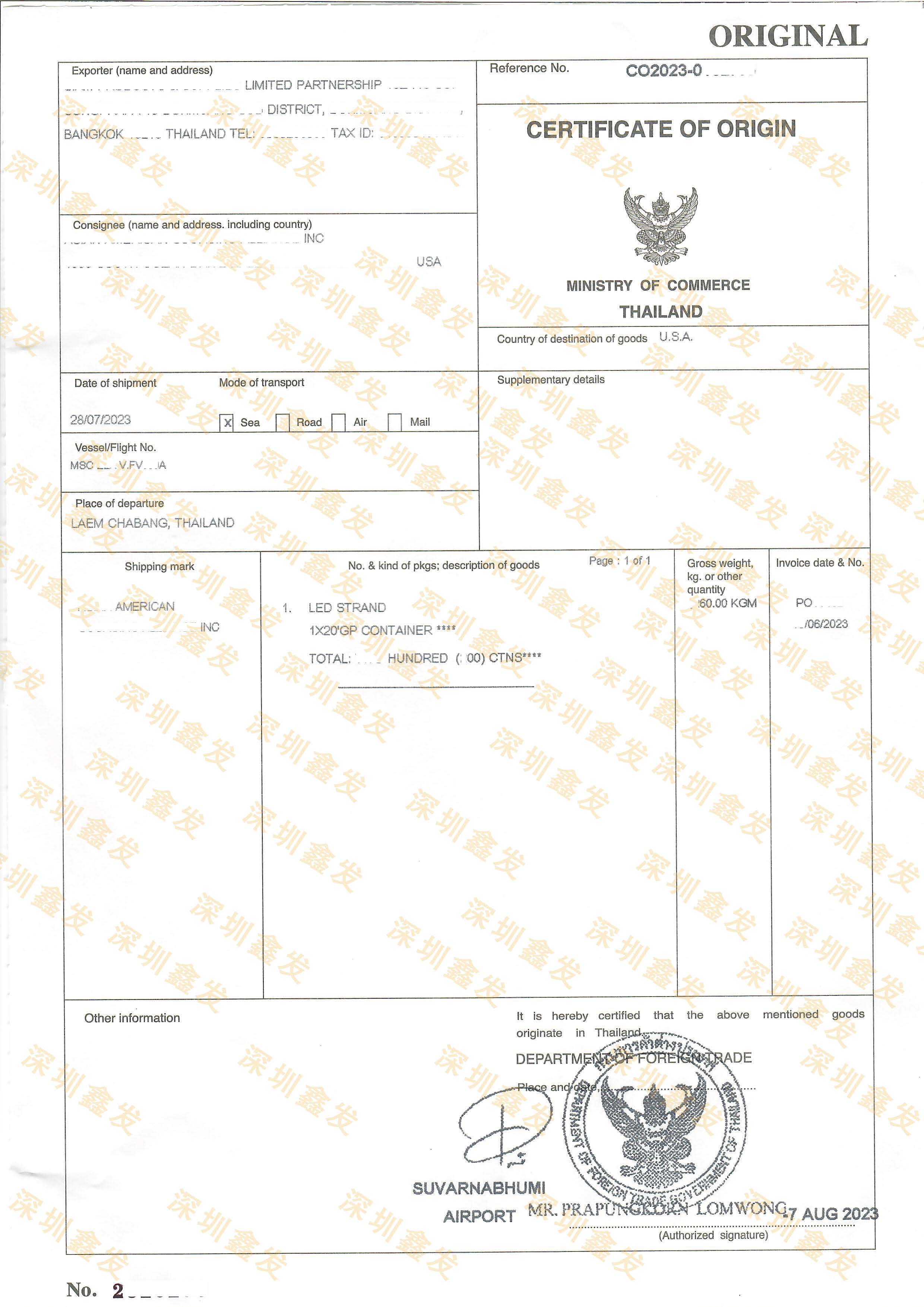

Thailand is strategically located at the heart of Southeast Asia. Major ports like Laem Chabang are well connected to global shipping routes, significantly reducing transit time. As a member of ASEAN and a participant in agreements like the Regional Comprehensive Economic Partnership (RCEP), Thailand allows certain goods to be re-exported with renewed certificates of origin (e.g., FORM E, FORM D), enabling low or zero tariffs when entering target markets.

Our Advantages in Thailand Re-export:

1: Extensive Experience – Over 10 years of operational experience in Thailand, with the ability to switch containers both in bonded zones and inland.

2: Factory Resources – Partnerships with factories producing quartz stone and cabinets, supporting the issuance of genuine certificates of origin.

3: Strong Risk Control – All certificates and supporting documents we provide are legal and compliant, ensuring smooth customs clearance through effective cooperation with inspections.

Thailand Re-export Process:

1:First Leg: Export from any Chinese port to Laem Chabang, Thailand under standard customs declaration. We provide consignee information, and domestic tax rebate is unaffected.

2:Transit: Upon arrival in Thailand, we handle container pick-up and switching, and provide certificates of origin and related documents.

3:Second Leg: Cargo is loaded onto the second-leg vessel. Customs clearance at destination is completed using our documents (Thai CO, packing list, invoice, B/L).

4:Destination Clearance & Delivery: DDP/DDU delivery to door in Europe and the U.S. via third-party license clearance.

5:No Traceability: The destination port cannot trace the goods’ origin back to China true country of origin

Packaging Requirements for Re-export Products:

No markings indicating “Made in China,” “中国制造,” or any Chinese characters

Get re-export plan Please provide: Product name/HS/Container value

TEL/WeChat/Whatsapp: +86 13874188321

Email: [email protected]

在线留言

If you have any suggestions or question for us.Please contact us.